Do you need an LLC or Business License To Sell on Amazon?

A short answer to the question is, No. You do not need an LLC or any kind of business license to sell on amazon. However, it is always recommended to have an LLC or C corporation to sell on amazon if you are serious about your business.

Since it protects you from any liability arising from selling on amazon as well as separates the owners from the registered legal entity.

If you are selling in the US or Amazon US or for that matter any of the marketplaces listed below you do not need LLC or Business license to start with.

It covers the following marketplaces in the US :

- Shopify

- Walmart

- eBay

- Amazon and others.

But as always said separate legal entity is always better than selling directly on any of these marketplaces since you are directly liable for your actions if you do not have a separate legal entity.

When should you register your LLC or C Corp?

LLC means limited liability corporation, which means an entity formed to limit the liability of the owners in case of any defaults or losses.

If you are selling on marketplaces we would recommend you register your LLC as soon as you start selling on Amazon or Walmart. Walmart generally recommends a separate entity. But if you don't want to spend or wish to have a separate entity then you can wait till you start having at least $10,000 monthly revenue. But as always earlier the better. Unless you don't plan to grow or want to have limited sales on marketplaces like amazon etc.

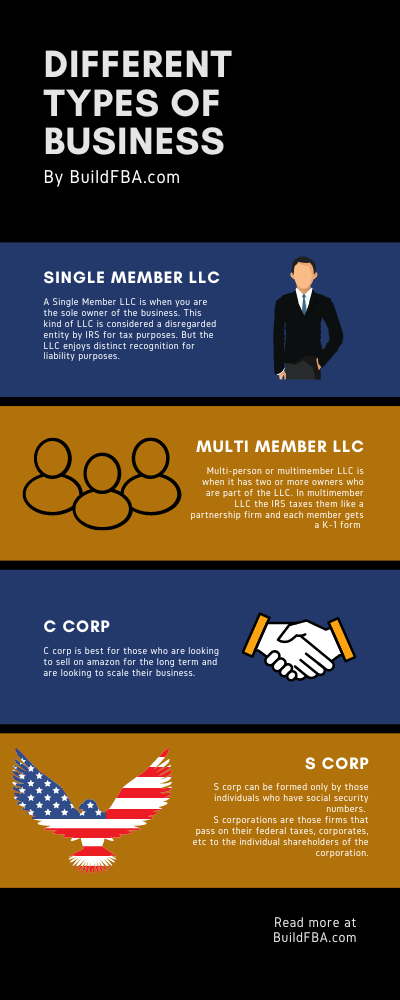

Different types of business registration:

1. LLC: Single Member LLC and Multi-person LLC

A Single Member LLC is when you are the sole owner of the business. This kind of LLC is considered a disregarded entity by IRS for tax purposes and considers a sole proprietorship. Basically, any profit earned is directly added to your personal income. But the LLC enjoys distinct recognition for liability purposes.

Multi-person or multimember LLC is when it has two or more owners who are part of the LLC. In multimember LLC the IRS taxes them like a partnership firm and each member gets a K-1 form which is used to calculate each member’s personal income. Mulimember LLC isn't considered a disregarded entity.

Key Takeaway

Both Single member and multi-member LLCs have bankruptcy protection for their owners.

2. S- Corp

S corp can be formed only by those individuals who have social security numbers.

S corporations are those firms that pass on their federal taxes, corporates, etc to the individual shareholders of the corporation. Also, the deductions get passed on.

This is best for very small business owners but isn't that beneficial for those looking to sell on marketplaces.

3. C-Corp

C corp is best for those who are looking to sell on amazon for the long term and are looking to scale their business.

At the same time, it has higher compliance requirements than an LLC. Though LLC also does the job. But if you are a single owner then LLC may not work for you.

Benefits of registering an LLC or C- Corp:

1. Liability benefits

LLC being an independent entity, its members are not personally liable for its actions. The assets of members stay secured from LLC liabilities.

Similarly, C-Corp being a separate entity of its shareholders, any liability of the C-Corp is alone and does not pass it on to its shareholders.

2. Accounting benefits

It always helps to have a separate entity, since an entity is separate from its owner, helps in accounting when your bank account for your business is different from your individual savings or current account.

3. Management benefits

When you try to run your business in your own name it can have many conflicts with not just your personal expenses but also with your partners if you have one. Separation of management is very important in any business. Thus having separate entities helps in having separation of business and personal expenses.

4. Tax benefits

Since LLCs and C- Corps have different legal entities, they are also taxed separately, thereby most firms in the US enjoy lower rates of taxation as compared to individuals.

We always recommended you check with your CPA based on your individual tax rate.

5. Amazon Lending Benefits

If you are looking for raising money from Amazon ie. Amazon lending, then having a separate corporate structure helps. Since it helps in protecting your personal assets in case of default. Also if you don't have an SSN amazon won't lend in your name. But if you have US Corporation, then Amazon lending won't be a problem for you, even if its owners are non-US citizens.

How to register a business?

1. Choose a Business Structure

First, you have to decide on the structure of your business, will it be single-person LLC or multi-member LLC, or C corp?

As discussed above various business structures are available to register. You need to decide on the structure of your business based on your requirements. Some businesses can work perfectly in an LLC nature, while others may be better suited to being a C corp.

Though we always recommend our students to go with C Corp, since it helps in the long term but has a little higher paperwork. Whereas if you are multi-partner, then multi-partner LLC is a good choice for you.

2. Register a DBA “Doing Business As” Name

You can then go ahead and decide on the name of your business, which is also called as “DBA” or “Doing Business As” name. Which also determines your branding and business name for the company.

3. Get a Federal Tax ID:

Once you register your business, you are automatically allotted EIN and also known as Employee Identification Number. It's an SSN of your LLC or C- Corp. this you need to file your federal income tax and to pay corporate taxes if any are due. This is one of the documents that amazon will ask to determine whether you are a US corp or non-US corp.

Once you have the EIN number, you can put it on amazon central so that it can identify your business as a separate entity.

Also, refer to our detailed guide on how to set up an LLC and C-Corp.

Do you need to be registered to sell on amazon?

As already mentioned before you dont need to be registered to sell on amazon but having a registered firm always outbenefits of not having a registered firm.

Do you need seller’s permit to sell on amazon?

You don't need seller's permit to sell on amazon.com. But you would need to file your sales tax returns once you cross a threshold.

Which is generally higher than 25,000 USD per month. And there are tax service providers who do that at the click of a button.

You don't have to pay sales tax since that's already taken care by amazon as third-party marketplace facilitator.

Basically, If you are someone selling less than 25,000 dollars on amazon per month you dont need sellers permit since you wont be liable for sales tax in most jurisdictions.

But with recent changes in marketplace law its good to have resellers permit if you want to sell on amazon through wholesaling.

Also if you want to buy from Alibaba and sell on amazon.

Samrudha Salvi ‧ Author

With more than 5 years on selling on amazon, and helping 100s to get started on Amazon.